You may pay in installments on Perpay’s online marketplace, which can help you establish credit. Perpay does not impose any fees or interest on your transaction. However, direct deposit payments are required.

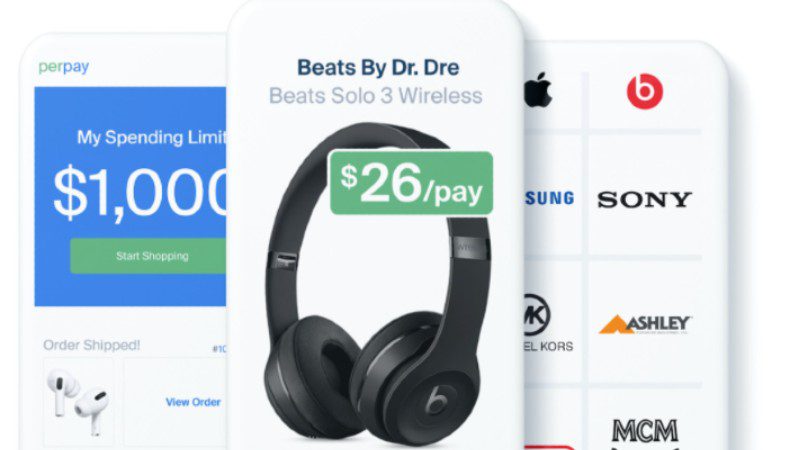

Perpay Buy Now, Pay Later is a buy now, pay later business that enables you to divide a purchase into a number of payments that, if you opt in, are automatically taken out of your paycheck. Your payments are due each time you receive a paycheck. You may purchase from more than 1,000 merchants who accept Perpay online via Perpay’s marketplace. Popular businesses include Dyson, PlayStation, and HP.

How is Perpay put to use?

The use of Perpay is free. When you apply, there won’t be any effect on your credit score, and you’ll be given a spending limit depending on your income. You specify the number of payments you want to make toward your purchase, and you divide it up into that number.

You must fulfil the following conditions in order to be eligible for Perpay:

- Actively pursue and keep a full-time job.

- You have worked for your present workplace for three months straight.

- Receive payment by direct deposit.

- I possess a functioning cellphone.

Is perpay legit? They do not have any active bankruptcies. be in good standing with regard to all debts. If you operate as an independent contractor, gig economy employee, or are self-employed, you are not permitted to utilise Perpay.

Benefits and drawbacks

Pros

- There is no damage to your credit score when you apply.

- Your income will be used to determine your spending cap.

- Select how many payments you’ll be making.

- After you order the item, payments are withdrawn from each paycheck, and you can spread them out over a maximum of six months.

- not add interest to purchases.

- Utilizing Perpay’s services won’t pay you anything in interest.

- No costs.

- There are no penalties for late or omitted payments with Perpay.

- Utilizing the mobile app is simple.

- Both the Google Play and Apple stores have positive reviews of It ‘s mobile application.

- You’re able to manage your payments via the app as well as explore items from different firms that are offered in the Perpay marketplace.

- Utilize Perpay+ to build credit.

- To have your payments reported to the three main credit agencies, you must register for Perpay+ (Experian, Equifax, and TransUnion).

- You may use the add-on to accumulate credit from your purchases.

- It is meant to help you improve your credit score—as long as you make on-time, consistent payments.

Cons

- Only able to buy things on Perpay’s online store.

- While other BNPL businesses let you use their service to shop on store websites or in-person, Perpay exclusively lets you make purchases through its website or mobile application.

- You must pay your payments by means of automated deductions from your salary.

- You must pay for your purchase using the payment plan offered by Perpay over a certain number of paychecks.

For whom is Perpay ideal?

The greatest alternative for debtors is Perpay, which offers greater repayment flexibility than the typical buy now, pay later, “pay in four” option. With Perpay, you may select how many payments you wish to make gradually, and those payments will be taken out of your salary on a regular basis.

Be cautious.

- Programs that let you buy now and pay later could tempt you to make a purchase that you might not otherwise be able to make.

- Even though the payments from each paycheck seem insignificant, the overall expense may still be high.

- Before making the purchase, make sure you have enough money in your budget for it.

- The amount that It deducts from each paycheck until you pay off your purchase is determined by the qualifying period you choose; there is no specific number of payments required.

- The “pay in four” option is one that the other two businesses provide, allowing you to spread out your pay over four installments.

- Additionally, each firm has linked with thousands of other businesses, enabling them to buy now and pay later for a wide range of products.

How reliable is Perpay?

The Better Business Bureau, a nonprofit organisation dedicated to consumer trust and protection, has given It an A+ rating. The BBB assesses businesses based on how they handle consumer complaints, how honest they are in their advertising, and how open they are about their business processes.

There haven’t been any recent problems with Perpay. However, a stellar BBB rating and a spotless background aren’t guarantees that you’ll get along well with the lender, so be sure to ask your friends and relatives about their experiences with the product before using it.

Perpay’s Products

Numerous prestigious American and international firms have worked with It. They provide you with a wide variety of goods with a focus on electronics, fashion, beauty, home decor, and other areas. The website offers products from brands including Michael Kors, Samsung, Nintendo, Apple, and Kitchen Aid. You have the option to pay in instalments if you are unable to pay in full at the register with cash. I believe this website has something valuable for both men and women.

Shipping Policy for Perpay

Your things will be dispatched as soon as the initial payment is received. You may anticipate receiving your items in 3 to 5 business days. The delivery of a bigger, overweight item from your order can take a little longer. Shipping in such situation would happen in 3 to 4 weeks. You’ll receive a tracking number so that you can keep tabs on your orders. The cargo business will get in touch with you to arrange delivery once you make your first payment, usually a week later.

Perpay’s Return Policy

Some goods are returnable within 30 days after purchase. Some companies, meanwhile, won’t let you exchange your purchase. Returns are not accepted for products from brands including Michael Kors, Gucci, Coach, Lego, UGG, Lenox, and others. If your things come damaged or faulty, you are eligible to get free return shipping. If not, you’ll have to pay for it yourself and pay a $10 return charge. If you return any of your purchases, there is a 5% restocking fee as well.

How to Apply Using Perpay

You should be prepared to speed up the process by having your financial and personal information on hand, just like you would if you were asking for a loan. You will want current income information, such as that from a recent paystub, to complete your Perpay profile.

It establishes your spending cap in this manner. You may explore the market and add products to your basket after completing your profile. To get a personal spending limit and approval, send your cart in for review. When your application is accepted, you’ll receive information on how to proceed with the remaining payments. Items are mailed after the initial direct deposit payment from your paycheck. Not sure if Perpay is the best option for you?

Perpay Alternatives in 2022

It is a fantastic illustration of how online buy-now, pay-later options might increase accessibility for some consumers to major purchases. However, Perpay is not your only option and may not be the best one for you. With comparable services, payments might also be shared.

Here are three other choices to consider.

Affirm

Affirm is a pay-at-your-own-pace app that makes it simpler to purchase by letting you choose when to make payments. Be warned that depending on your credit, Affirm may require you to pay interest.

Splitit

Splitit is an interest-free buy-now, pay-later solution that makes use of your current credit lines. Remember that It is simply one option you could take into account if your objective is to establish or restore your credit. Bad credit loan choices, debt consolidation, or a secured loan/line of credit are further possibilities to assist you in strengthening your credit.

Quadpay

Quadpay, or what is now known as Zip, is a financing scheme that allows a buyer to pay for an item in four installments. In that context, this BNPL service will definitely allow anyone to cover important expenses.

FAQ’S

Is Perpay a credit bureau reporter?

To have your payments reported to the three main credit agencies, you must register for Perpay+ (Experian, Equifax, and TransUnion). After making on-time payments totaling more than $200 over the course of four months, the add-on enables you to establish credit on your purchases. If you make dependable, on-time payments, Perpay+ will help you raise your credit score. Perpay+ costs $2 per month, but it’s free when you aren’t actively paying off an order. Your payments won’t be reported to credit bureaus if Perpay+ is not activated.

Is perpay legit company?

Yes, Perpay, a business that lets you defer payments from your salary to cover the expense of an acquisition, is legal.

What occurs if Perpay is not paid?

According to Perpay’s terms and conditions, you are not obligated to make payments if you lose your job, experience a medical emergency, or encounter other unforeseen financial difficulties. According to Perpay’s terms and conditions, you are not obligated to make payments if you lose your job, experience a medical emergency, or encounter other unforeseen financial difficulties. “Do your best to restart payments when you can,” according to It. You won’t be assessed any penalties by It for late or missed payments. While a payment is still owed, you won’t be allowed to make any more purchases, and if you have Perpay+, any missed payments can be reported to credit bureaus.

Conclusion

For debtors who like to create their own repayment plans, Perpay’s buy now, pay later option is a fantastic option. With It, you may select payment plans that last up to 6 months, unlike other buy-now-pay-later businesses that only provide a few payback term alternatives. It benefits borrowers who are not self-employed full-time employees. Beware of the temptation to use It to make purchases that are outside the scope of your budget.